A minister explores the benefits of the parsonage allowance.

The Facts

Married couple, Age: 50

Frank's earnings: $65,000

Sally's earnings: $40,000

Frank's 401K savings: $300,000

Sally's 401K savings: $250,000

Non-retirement assets: $80,000

Consider Sally and Frank Wolf, age 50. Sally is a travel agent and Frank is a minister. Sally makes $40,000. Frank makes $65,000. The two live in a parsonage whose imputed rent (rental value) is $30,000. They will retire at age 65 and buy a house. Their earnings will stay fixed in today’s dollars.

Tax Advantage: The parsonage value (or church-designated housing allowance under IRS sec 107) is not subject to income taxation, but is subject to Social Security’s self-employment tax.

To enter this in MaxiFi Planner, treat Frank’s direct and in-kind compensation of $95,000 as self-employment earnings. This ensures that all $95,000 is subject to proper Social Security taxation. But, to eliminate federal and state income taxation of the $30,000 parsonage, enter a special expense of $30,000 for each year through retirement, but specify that it’s excludable from Adjusted Gross Income (AGI).

This tells the program to lower the couples AGI by $30,000 when it makes its federal and state income tax calculations. So this gets the income taxes right. It also gets the cash flow right. Franks’ cash flow is really only $65,000, since the $30,000 is coming in the form of in-kind housing services. But in entering the $30,000 as an AGI-excludable special expense, Frank’s cash flow ends up being $65,000 (the $95,000 entered as self-employment earnings less the $30,000 entered as a special expenditure).

The Base Plan

Discretionary Spending is Smooth—the Benchmark Case

Frank and Sally, like all of us, want to maintain our living standard through time. Economists call this consumption smoothing. It reflects human nature. No one wants to splurge today and starve tomorrow or vice versa. To help Frank and Sally achieve a smooth living standard, MaxiFi determines the annual discretionary spending their household can afford and leave all household members with each the same living standard through time.

It's a simple concept, but the patented algorithms underlying MaxiFi's calculations are highly complex. Using Frank and Sally's example to illustrate consumption smoothing, MaxiFi's shows us that the couple has $62,295 of discretionary spending in today's dollars, each year of their life through age 100.

So just what does this "discretionary spending" mean?

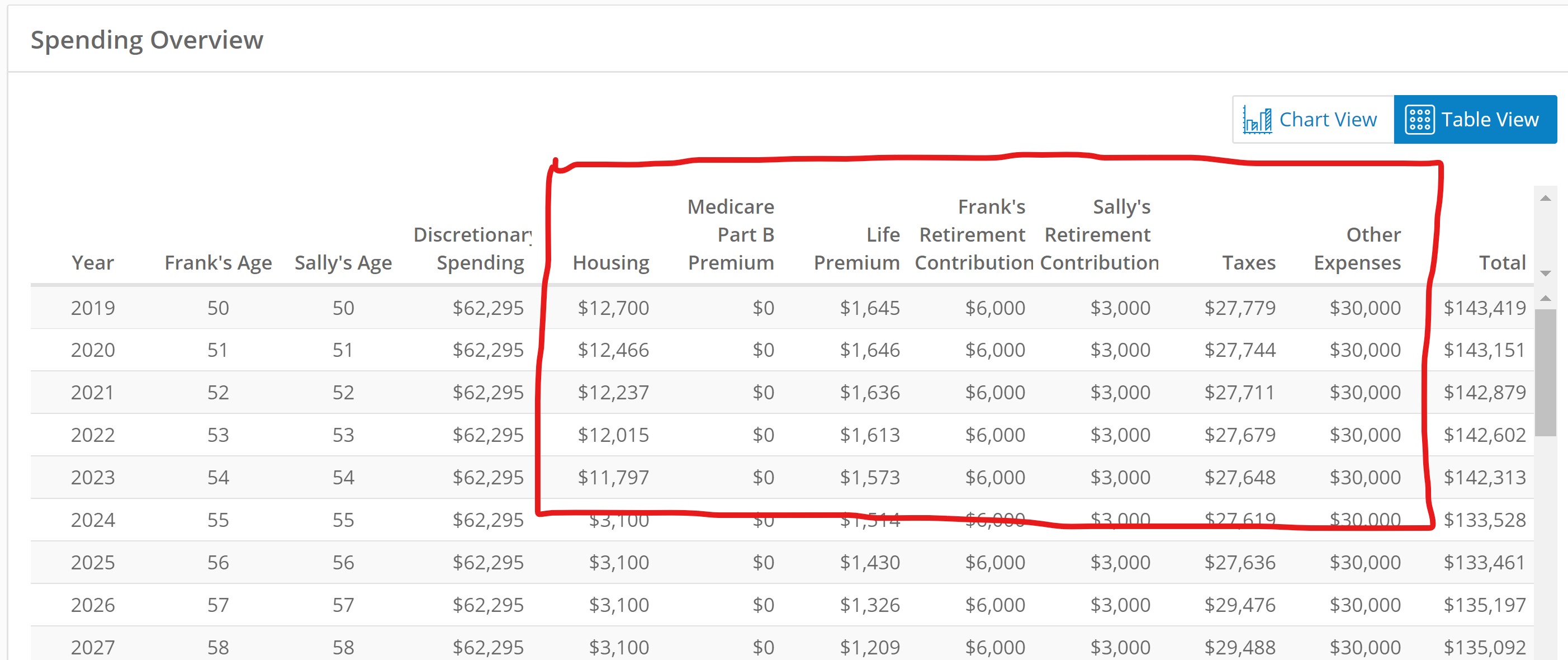

The easiest way to understand discretionary spending is to look at the Spending Overview report. Here we see that the total spending for the current year 2019 is $143,419. The columns inside the red box are treated as "fixed spending" and when we subtract fixed spending from total spending in each row, we are left with the discretionary spending of $62,295.

Fixed spending changes through time as mortgage costs decline in real terms and taxes rise and fall a bit, Medicare B kicks in, etc. But the the beauty of consumption smoothing is that discretionary spending remains the same.

How significant is the tax advantage?

Creating an alternative profile

To calculate the advantage of the church-designated housing allowance, we can set up an alternative profile and remove the "excludable from AGI" special expense and set the self-employment earnings back to $65,000.

First we add a new alternative profile by selecting the small down arrow at the top of the screen beside the Base Profile. We can label it "Tax Break." Now we just change Frank's labor earning back to $65,000 and exclude the parsonage adjustment we entered as a special expense.

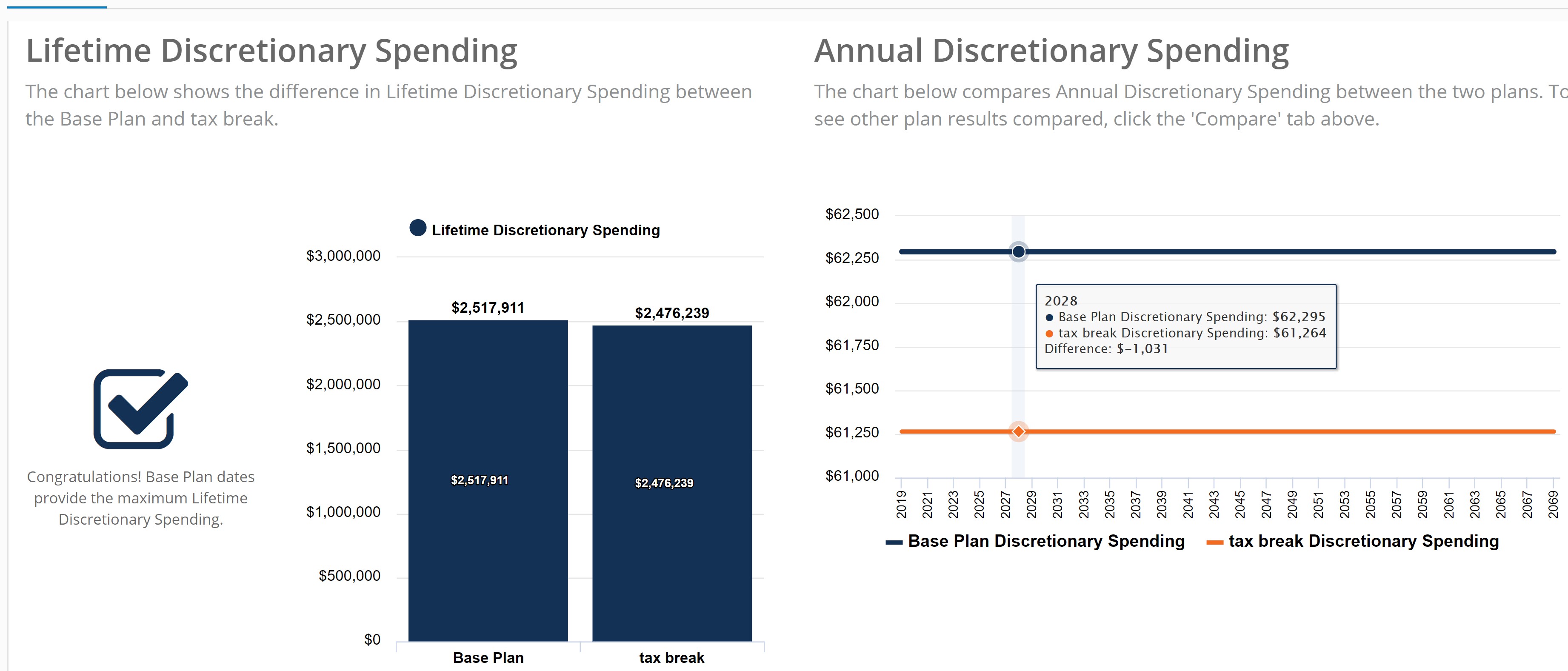

When we now run a comparison report, we see the following comparison of discretionary spending levels. This difference reveals the annual tax advantage of the parsonage adjustment represented in very practical terms as a change in annual spending allowance (i.e., discretionary spending).

The parsonage tax break changes Sally and Frank's annual discretionary spending in the amount $1,031, raising it from $61,264 to $62,295. The lifetime present value of this change is $41,672.