Your Base Plan

A complete lifetime roadmap for your income, spending, savings and life insurance needs

Once you have input your data, the software will present your Base Plan—a complete lifetime roadmap for your income, spending, savings and life insurance needs.

You can return to this Base Plan at any time to update with new information or expectations, or to see how your plan is impacted when trying to make life-changing decisions—whether to take a new job, when to buy a new home—or everyday decisions like how much to budget for groceries or entertainment.

Minimal, easy online data entry:

- Current and expected earnings

- Account balances for savings, checking, investment, and retirement accounts

- Expected contributions to retirement accounts—your contributions and your employers’ contributions

- Account balances and expected withdrawals for 529 Education Savings Accounts

- Pensions

- Social Security covered earnings and current benefits (if any)

- Primary and vacation home expenses (rent, mortgage, condo fees, etc.)

- Real estate holdings, receipts, and expenses

- Other expected major expenses or receipts

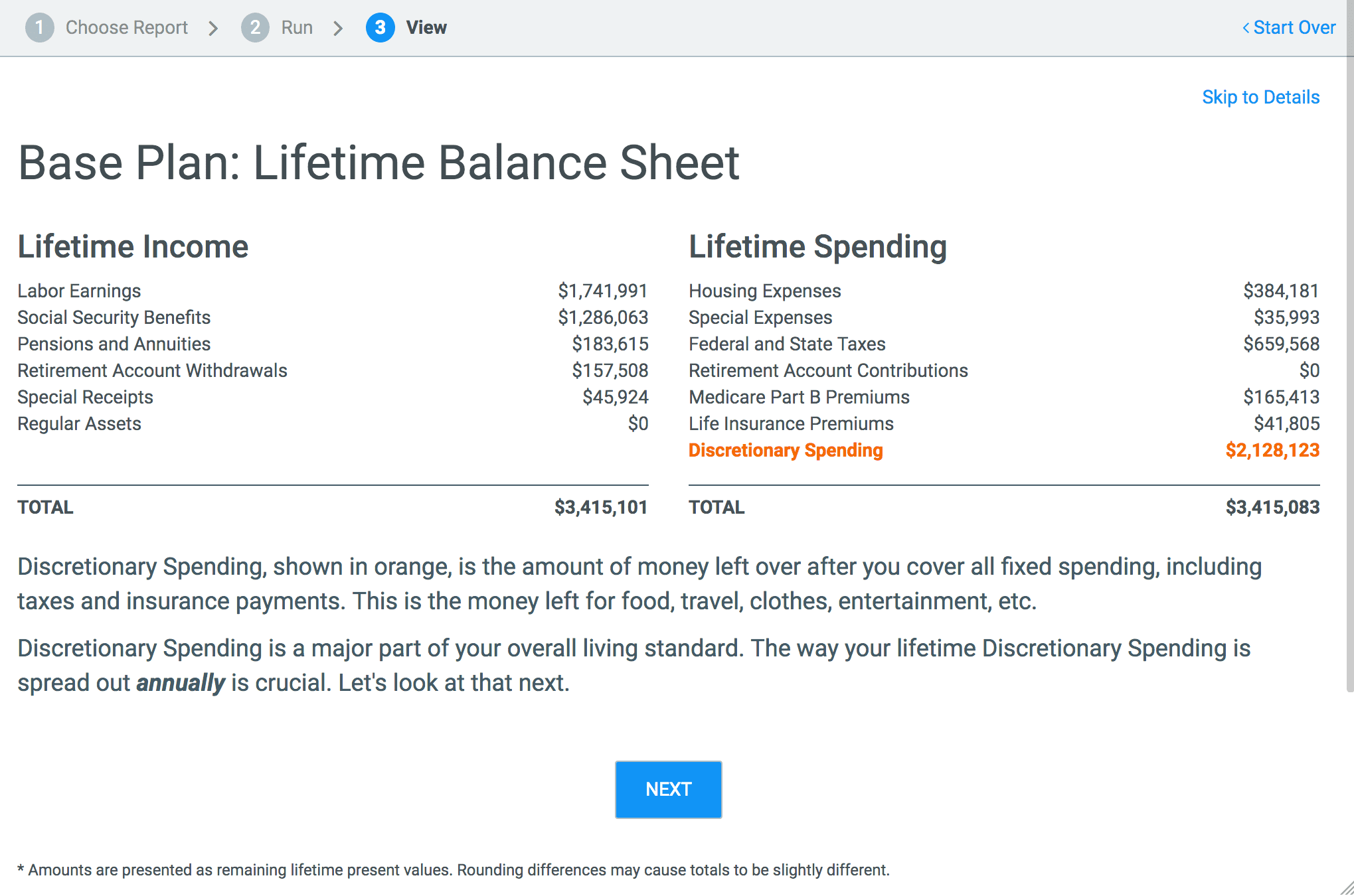

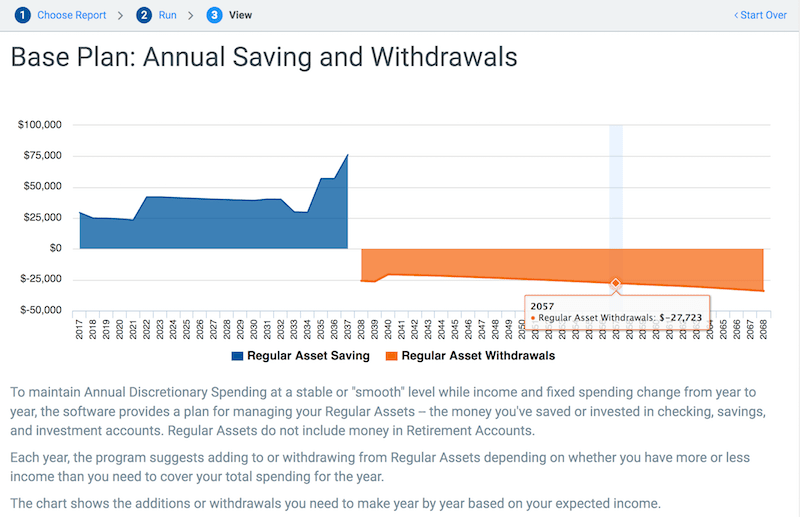

Clear, detailed and comprehensive reports:

- Lifetime Balance Sheet showing Projected Lifetime Income and Projected Lifetime Spending

- Annual income

- Annual spending—fixed and discretionary

- Annual suggested savings and withdrawals from non-retirement accounts (stocks, bonds, mutual funds)

- Annual suggested withdrawals from retirement accounts

- Annual cash flow for income for each spouse if married

- Annual household net worth

- Annual taxes – Federal, State and FICA

- Annual Social Security benefits

Adjust and re-run your plan as often as you'd like

Export as PDF or Excel

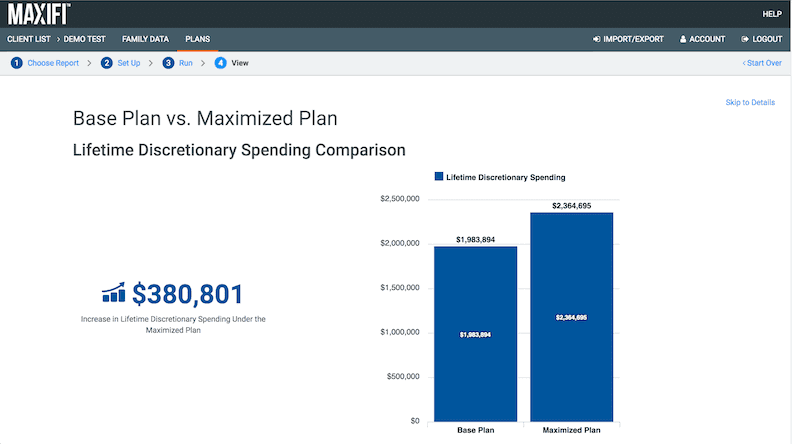

Your Maximized Plan

Maximize your Base Plan to find ways to safely raise your annual discretionary spending

Once you’ve created your Base Plan, MaxiFi's optimization engine can analyze thousands of scenarios to find ways to safely raise your annual discretionary spending—potentially increasing it by hundreds of thousands of dollars over your lifetime.

- Finds the best Social Security filing strategy to get the highest benefits for you and your spouse

- Calculates tax efficient retirement account withdrawal start dates

- Shows tax efficient Roth versus non-Roth withdrawals

- NEW Optimizes Roth conversions

Your Budget Tracker

Stay on track with your plan's spending and saving targets

When you're happy with your Base Plan, create a budget for the year with a few clicks. MaxiFi's Budget Tracker tool helps you keep on track to meet the key spending and savings numbers in your plan. It also allows you to make sure your income expectations for the year match your actual income.

- Set and update income, fixed spending, and savings targets for the year automatically from your Base Plan

- Create spending target categories based on a typical household budget or create your own

- Easily view and update your progress throughout the year at any time from any device

- Export your budget and your transactions data to Excel at any time

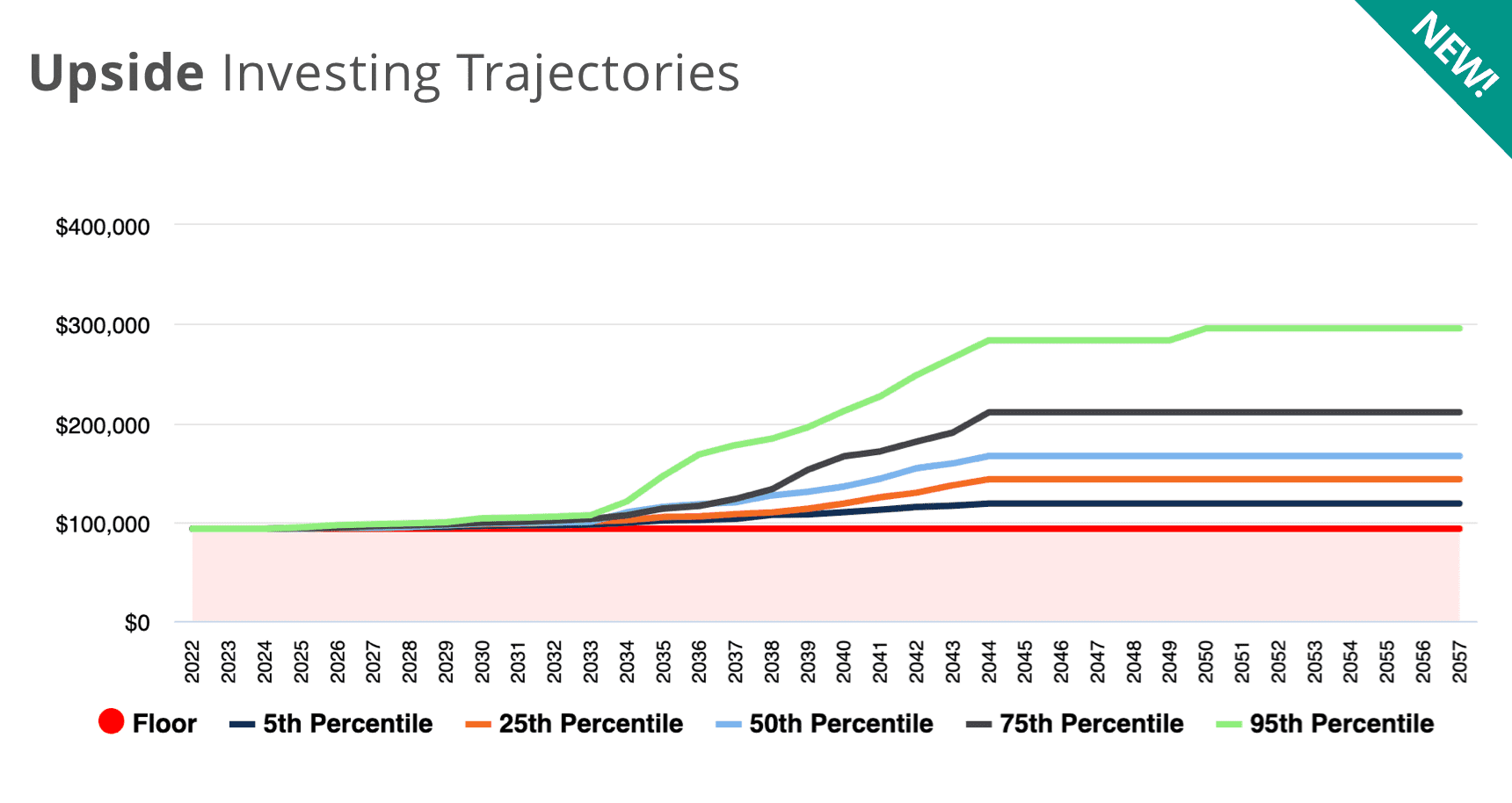

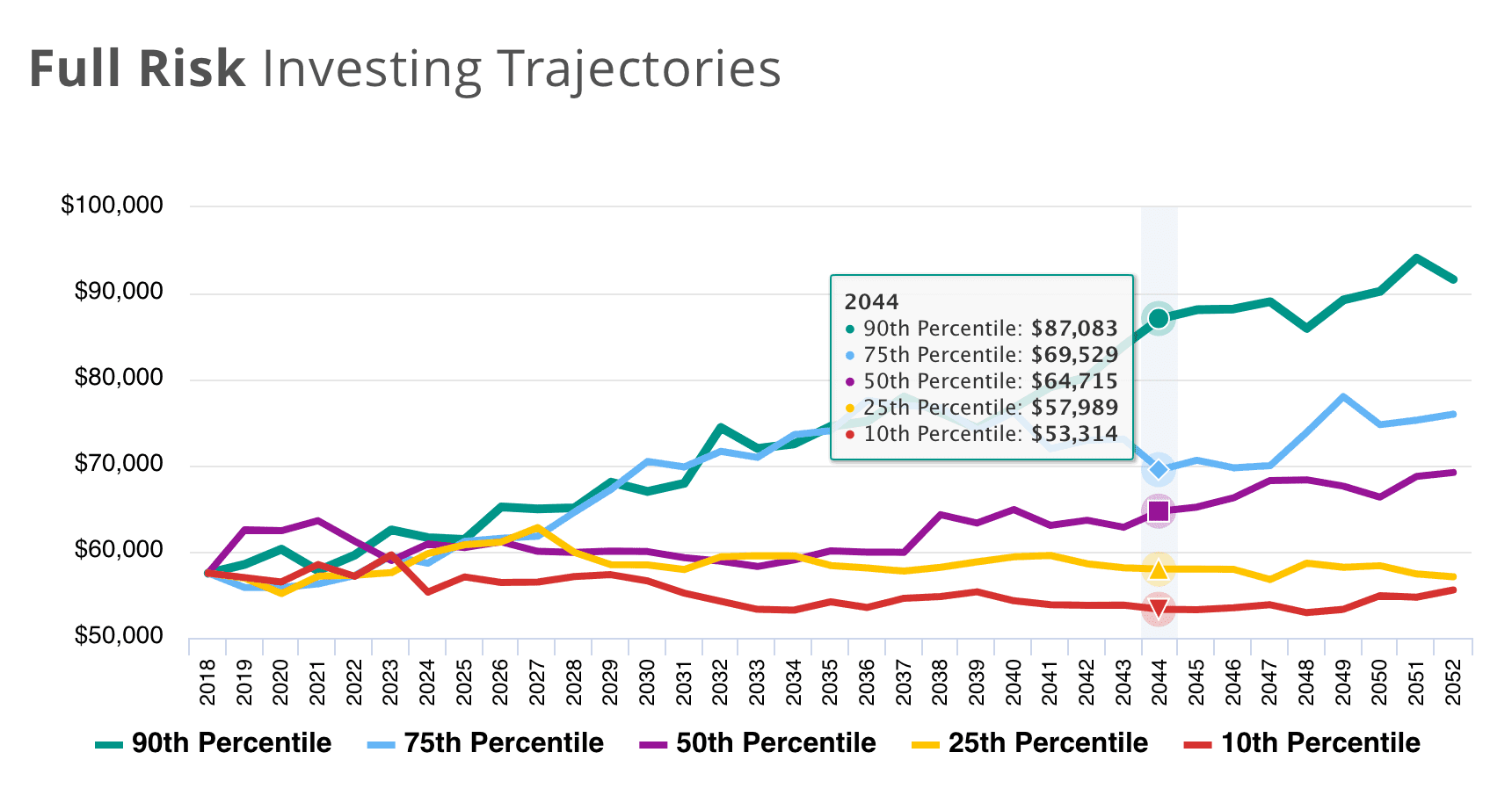

Living Standard Monte Carlo®

Manage your living standard risk

MaxiFi's Living Standard Monte Carlo® simulations show how different investment strategies and spending behaviors impact your bottom line – your living standard.

MaxiFi has two ways to run Living Standard Monte Carlo to help you balance living standard risk and return:

Upside Investing: Input current and future stock investments and when you'll exit the market. The software finds your base living standard floor assuming all other investments are safe and your stocks lose all value. As you exit the market, MaxiFi raises your living standard floor based on the simulated amount of stocks that have been converted to safe assets.

Full Risk Investing assumes you spend each year from both your safe and risky assets. You tell MaxiFi how you will invest through time and how aggressively you'll spend. This results in a plan with more spending in early years based on the presumption your risky assets will pay off.

Learn More: How Living Standard Monte Carlo® Works

Premium

Roth Conversion Optimizer™

Optimize Roth conversions to maximize your living standard

Roth conversions involve the transfer of retirement assets from a traditional retirement account, such as a 401(k) or SIMPLE IRA, into a Roth account. While the account owner pays income tax on the converted assets, future earnings and withdrawals from the Roth account can be made tax free.

Determining when to convert assets to Roth accounts and how much to convert in each year is an extremely complex problem. While other tools may be able to simply optimize for minimized taxes, MaxiFi is the only software that finds the annual conversion amounts that maximize your lifetime discretionary spending. It takes into consideration all these factors:

- Roth-conversion-induced changes in current and future taxes

- Required future minimum distributions from non-Roth retirement accounts

- The extent and degree of Social Security benefit taxation

- The time-path of Medicare Part B IRMAA premiums

- Cash-flow constraints

- Your willingness to accept a lower living standard in the short term in order to enjoy a higher living standard in the long term

- Your regular assets, Roth and non-Roth retirement accounts, Social Security, and other income streams

- Your assumed nominal return on regular assets and retirement accounts

- Your assumed future inflation rate

- Your household’s demographic composition

Learn more about how it works, or read our case study

Life Insurance Contingency Planning

Precise life insurance calculations for maximum peace of mind

MaxiFi's standard life insurance calculations are already extremely powerful. It's the only software that determines how much coverage your family needs in each year to maintain your current living standard if you or your spouse were to die.

But what if you plan to downsize your home if your spouse dies? In this case, life insurance needs will be overstated because selling your home will result in additional resources for you and other survivors. This is where MaxiFi's Life Insurance Contingency Planning feature comes into play.

Available in MaxiFi Premium, contingency planning allows you to enter changes if you or your spouse die early. Enter contingencies for Housing, Future Earnings, Special Receipts, Special Expenses, and Retirement Account Contributions, customized based on your personal circumstances and choices. MaxiFi takes these changes into account, and ensures that life insurance coverage amounts accurately consider the new financial situation while maintaining your household's current living standard.

Our Calculations

MaxiFi puts the most powerful, accurate financial planning approach into your hands

Based on years of research and fine-tuning, MaxiFi’s Economic Security Computation Engine puts the most powerful, accurate financial planning approach into your hands. Find out what makes our software smarter and better. Our engine makes highly detailed annual Federal and State tax calculations and considers the full range of Social Security benefits.

We allow you control over dozens of settings so you can model different maximum ages, inflation rates, changes to Social Security benefits or tax rates, and many others.

Tax Considerations

- Fully updated with One Big Beautiful Bill Act (OBBBA) of 2025 tax changes

- Includes SECURE Act 2020 rules for Required Minimum Withdraws

- Federal income taxes

- FICA taxes

- State income taxes

- The Alternative Minimum Tax

- Itemization decision

- Tax credits

- Deductions and exemptions

- Capital gains and dividends

- State-specific schedules

- Social Security benefit taxation

- Federal bracket indexation

- Capital gains on home sales

- Municipal bond preference

- Self-employment tax

Social Security Benefits

- Retirement Insurance Benefits

- Spouse’s Insurance Benefits

- Divorced Spouse’s Insurance Benefits

- Social Security Disability Insurance Benefits

- Child In-Care Spouse’s Insurance Benefits

- Widow(er)’s Insurance Benefits

- Divorced Widow(er)’s Insurance Benefits

- Child’s Insurance Benefits

- Childhood Disability Benefits

- Surviving Child’s Insurance Benefits

- Father’s and Mother’s Insurance Benefits

Social Security Rules and Provisions

- New Social Security laws and grandfathering rules

- Early benefit reductions

- Delayed retirement credits

- The earnings test

- Adjustment of the reduction factor

- Re-computation of benefits

- Option to suspend and reinstate retirement benefits

- Family maximum

- Combined family maximum

- Disabled family benefit maximum

- RIB LIM on widow(er) benefits when deceased spouse claimed early

- Restricted application and deeming rules

- Alternate widow(er)’s benefits when the deceased spouse died before age 62