When the Tax Cuts and Jobs Act of 2017 (TCJA) was signed into law, MaxiFi implemented these changes immediately. Even though these changes have been in place now for several years, it's still important for you understand how these changes impact your personal finances. We let you run your plan with different assumptions and future expectations about taxes. We’ll show you how below, but first it’s important to understand some basics about the TCJA.

What Changed With the TCJA of 2017?

The TCJA changed most elements of federal personal income taxation, specifically:

- Changed tax rates and tax brackets, including reducing the top rate to 37 percent

- Eliminated personal exemptions

- Raised the standard deduction

- Raised the child tax credit

- Modified the Alternative Minimum Tax

- Placed a limit on the deductibility of state and local income taxes

- Eliminated the deductibility of alimony payments on divorce and separation agreements signed after December 31, 2017

- Revised the brackets for qualified dividends and long-term capital gains

- Reduced the threshold for itemizing medical deductions to 7.5% for 2017 and 2018

- Eliminated the overall limitation on itemized deductions

- Changed the inflation indexing of tax parameters to the Chained-CPI-U

- Limited the deductibility of mortgage interest (more information below)

- Introduced a special exemption for income from certain pass-thru businesses (more information below)

Many of the personal income tax provisions of the TCJA will revert back to the pre-TCJA provisions in 2026 unless Congress takes action to extend or make the changes permanent.

How Does it Impact My Plan?

We handle most of the complexity behind the scenes. You can simply rerun your plan and the provisions of the TCJA will automatically be used.

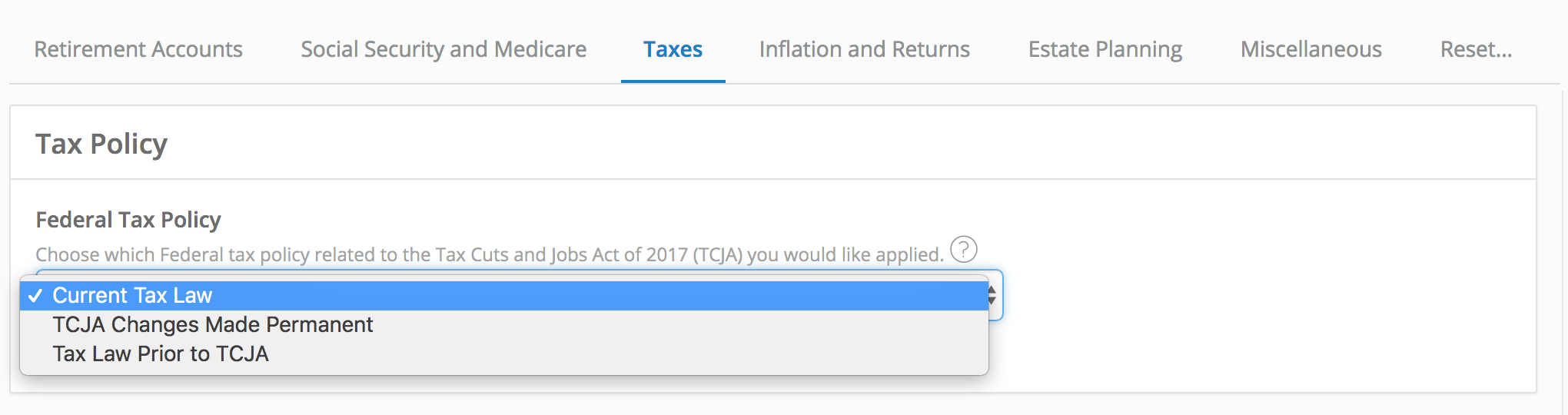

But to help you gain a better understanding of how the tax law impacts your plan, we provide three different “Federal Tax Policy” options:

- Current Tax Law: This is our default setting. It applies the TCJA changes as written in law, which means many of the changes, such as reduced income tax rates, expire on December 31, 2025.

- TCJA Changes Made Permanent: This option assumes the TCJA changes that are set to expire in 2025 are instead made permanent by Congress.

- Tax Law Prior to TCJA: This option applies the tax rates and provisions that were in place prior to the TCJA.

This option is available in the Settings and Assumptions > Taxes tab. You can, for example, leave your Base Plan at the default setting and then create an Alternative Profile with the “TCJA Changes Made Permanent” setting to see how your plan changes if the TCJA provisions are extended beyond 2026.

Mortgage Interest Deduction

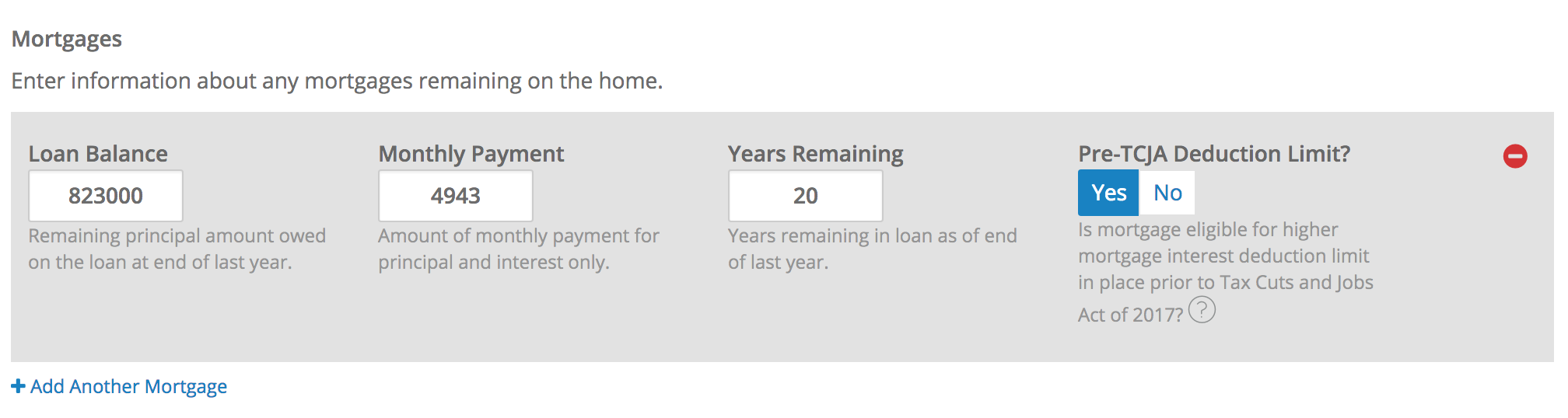

The TCJA reduced the federal income tax mortgage interest deduction from the amount of interest paid on $1,000,000 of debt to interest paid on $750,000 of debt. If your mortgage originated on or before December 15, 2017, it falls under the higher pre-TCJA limit. If it originated later, then it falls under the lower limit of the TCJA. The exception is if you refinance a mortgage after December 15, 2017 that originated before that date. In this case, as long as you only refinance the remaining balance or less, the higher pre-TCJA limit applies to the refinanced mortgage.

In order to be sure the correct limit is applied to your mortgage(s), when you enter a mortgage for your Primary Residence or Vacation Home in the Housing section you can specify whether the higher, pre-TCJA limit applies or not.

Deduction for Qualified Business Income of Pass-Thru Entities

The TCJA introduced a deduction for qualified business income (QBI) from pass-thru entities to give taxpayers who have that type of income some of the same benefits that corporations got with the reduction of the corporate tax rate from 35% to 21%. The law allows a maximum deduction of 20% of QBI.

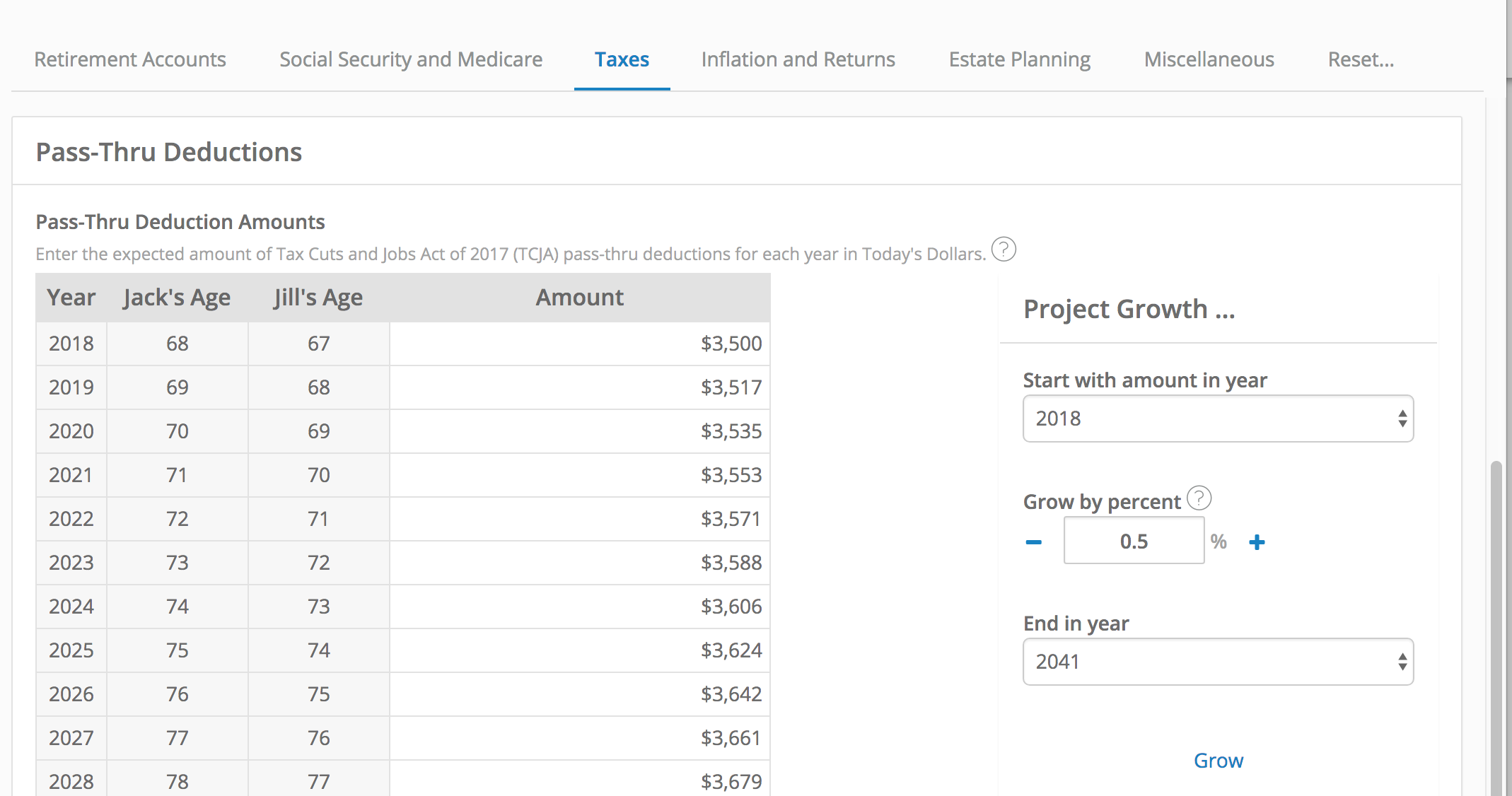

You can enter anticipated deductions for QBI from pass-thru entities on the Settings and Assumptions > Taxes tab. Be sure that the income itself is accounted for elsewhere in the program: real estate rental income should be entered on the Real Estate screen and other business income subject to income taxation can be entered as a Special Receipt.