Any financial plan involves risk.

How will stocks, bonds, and other investments perform? More importantly, how will their performance impact your family’s living standard? What are the chances your future living standard will rise through the roof or fall through the floor?

MaxiFi’s powerful Living Standard Monte Carlo® tools — Upside Investing and Full Risk Investing — help you manage your living standard risk with confidence.

Smarter Monte Carlo

Old-school Monte Carlo, used in conventional financial planning, is deeply flawed.

First, it uses an outdated, extremely rough “rule of thumb” to set a post-retirement annual spending target. This approach is sure to miss the mark, potentially by a huge margin. Second, it calculates the probability of plan success — the chance you can spend this exact amount year after year and not go broke.

This makes aggressive investing — including in managed funds with high fees — look good because riskier, but higher yield plans have a smaller chance of failure.

But blindly spending the wrong amount year after year, regardless of how your investments perform, and using the wrong spending target makes no sense. Worse, this strategy raises the chances of going broke early in retirement with far too many years left to finance.

MaxiFi takes a smarter approach.

Smart Trajectories

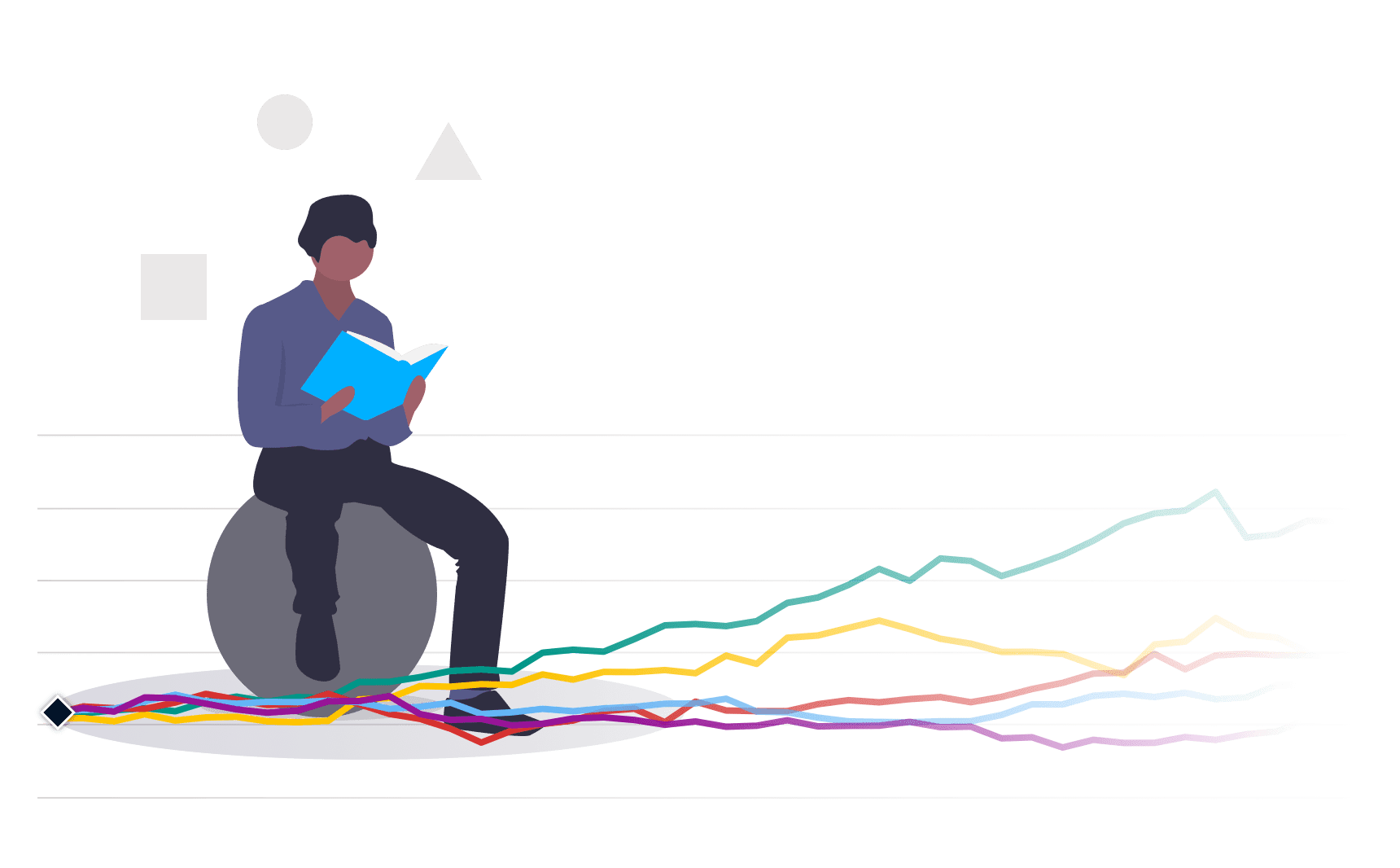

MaxiFi’s Living Standard Monte Carlo® incorporates your investing strategy and spending behavior to simulate hundreds of annual spending trajectories, each differing based on the different investment returns you may earn through time.

Along each trajectory, the tool determines, for each year, how much you should spend given how your investments performed in prior years. In other words, it adjusts your future spending in light of your past returns. This adjustment considers not only your asset balances at that point in the simulation, but also how aggressively you want to spend.

You can run MaxiFi in Full Risk Investing mode or Upside Investing mode to explore investing and spending strategies that generate your best balance of living standard risk and reward.

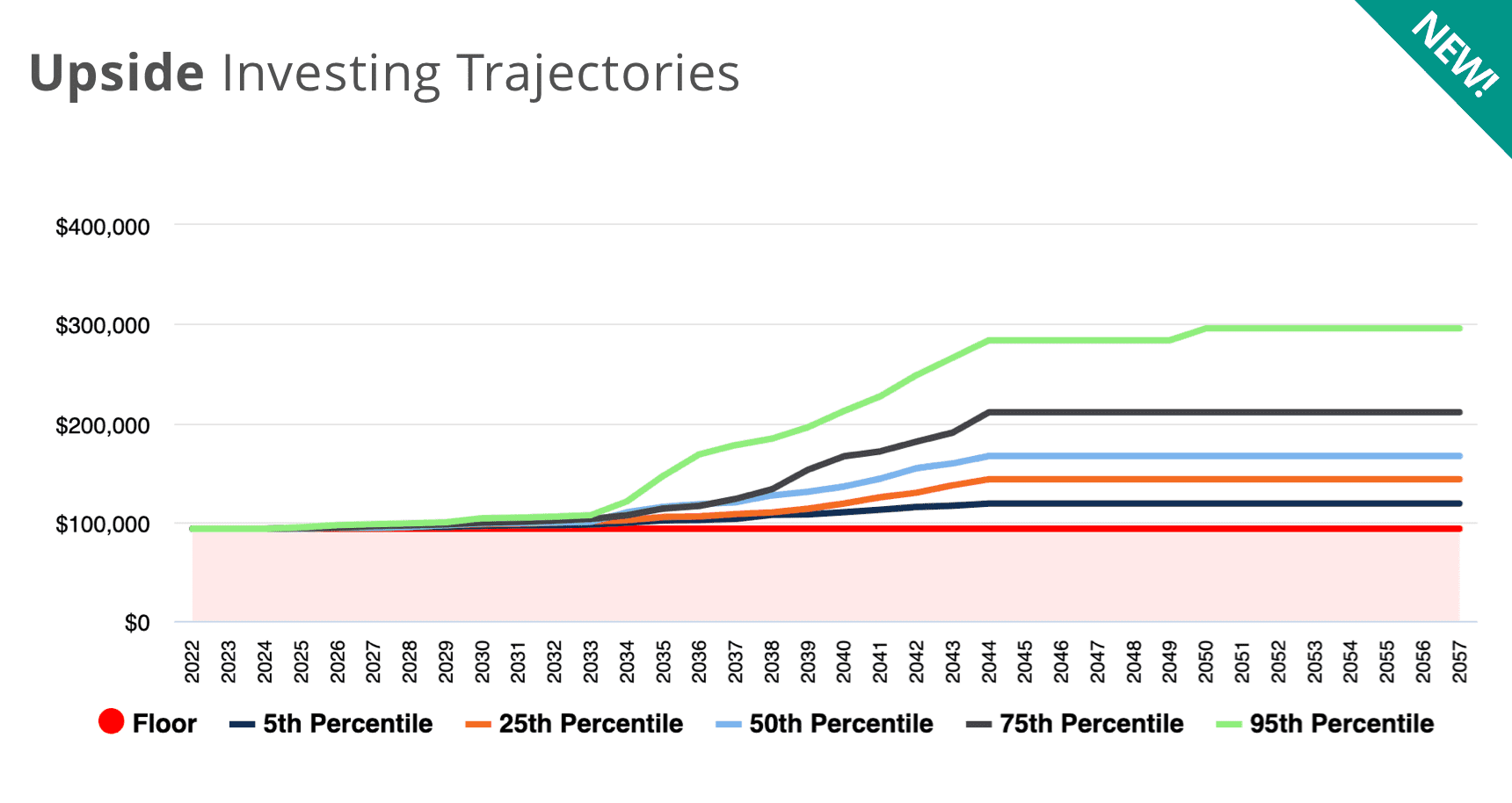

Upside Investing

Upside Investing entails investing in just two things: stocks and safe assets (e.g., inflation-indexed Treasuries). You tell MaxiFi how much you have in the stock market, what you'll add to the market, and when you'll convert stocks to safe assets. Next, MaxiFi calculates your base plan assuming your stocks lose all value. This establishes your base living standard floor.

MaxiFi then runs Monte Carlo simulations on your possible stock returns. Along each return trajectory, MaxiFi converts stocks to safe assets as directed. All extra safe assets are used to raise your living standard floor. Hence, you experience only upside opportunity relative to your base living standard.

In short, Upside Investing treats stocks like gambling money and doesn't spend any winnings until you've left the casino. With Upside Investing, the more you invest in stocks, the lower your base living standard floor and the higher your potential upside. And vice versa.

Full Risk Investing

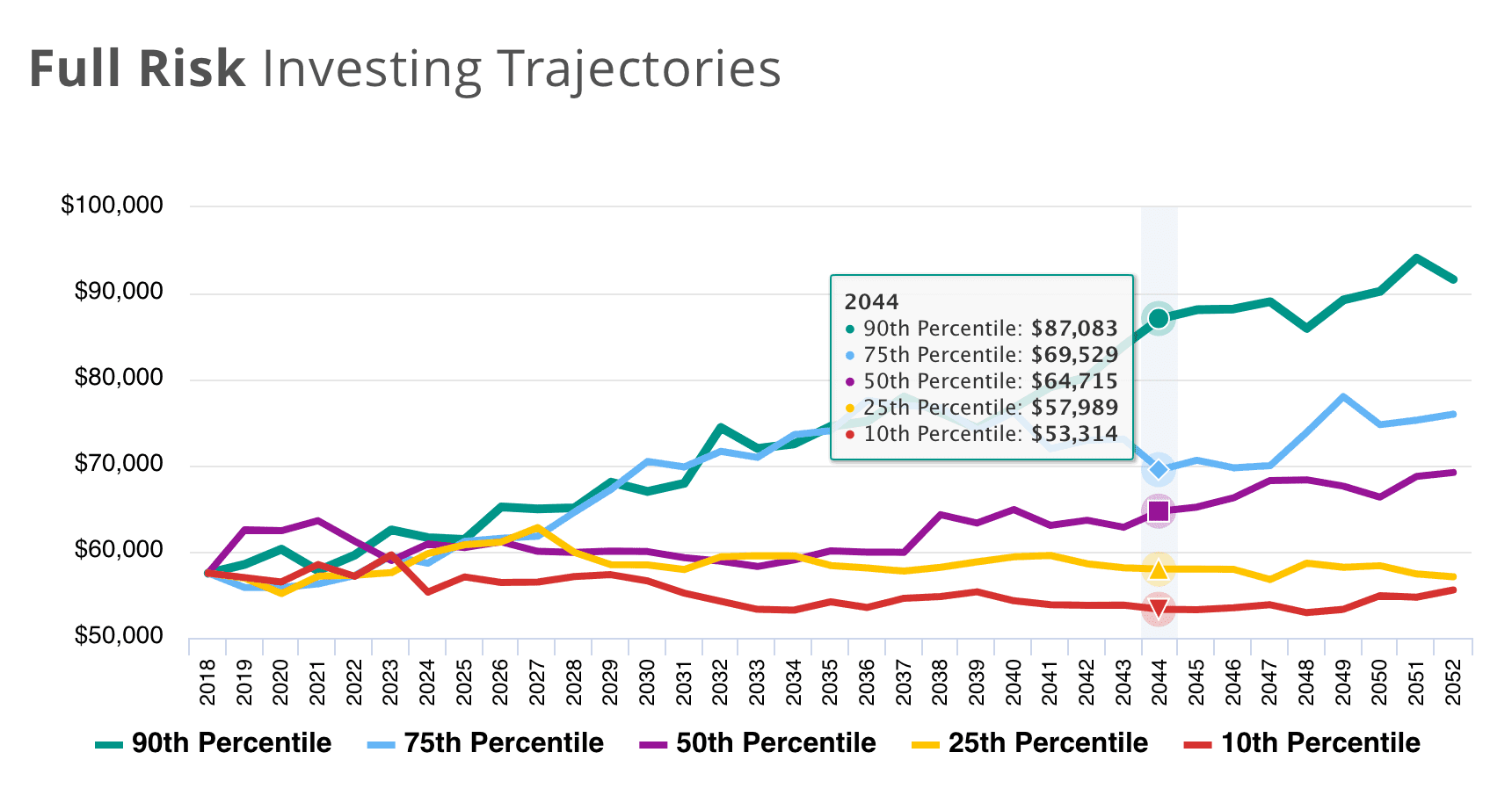

Full Risk Investing asks you to specify your current and future investment strategy as well as how aggressively you wish to spend out of all your assets, risky as well as safe. It then simulates hundreds of annual spending trajectories, each differing based on different paths of investment returns you may earn through time.

Along each return trajectory, the tool determines, for each year, how much you'll spend. In other words, it adjusts your spending based on investment performance. The associated living standard trajectories can feature higher or lower future living standards. Hence, Full Risk Investing entails both upside and downside living standard risk.

By analyzing different investing strategies and spending behaviors you can quickly assess their risk and choose the combination that provides the right balance of living standard risk and reward.