The couple realizes that there are tax breaks associated with contributing to a 401(k). But they don’t want to have less liquidity going forward.

The Facts

Married couple, Age: 30

Hannah’s earnings: $50,000

Connor’s earnings: $50,000

Regular Assets: $120,000

Housing: $600,000 owned home

Mortgage: $480,000

Monthly Payment: $2,182

Given the crazy gyrations of the stock, bond, and real estate markets, Hannah and Connor, whose basic data is listed above, wonder if they should pay off their mortgage early with their own (not their employers’) 401(k) contributions. Right now, Hannah and Connor have their 401(k) money invested in an S&P index fund. They have some liquid regular (non-retirement account) assets, but want to keep those funds available for emergency purposes. Their specific question is whether each of them should stop contributing $1,500 each year (rising with inflation) to their 401(k) plans and, instead, use these funds to pre-pay their mortgage. Since their employers’ contributions aren’t tied to their own contributions, those contributions aren’t impacted by using what would otherwise be their own 401(k) contributions to pre-pay their mortgage.

The couple realizes that there are tax breaks associated with contributing to a 401(k). But they don’t want to have less liquidity going forward. This means that they’ll need to use the money they’d otherwise contribute to their 401(k)s to make the extra mortgage payments. On the other hand, the couple realizes that they are paying the prevailing 3.6 percent rate on 30-year mortgages. That’s a high rate relative to the 1.944 percent prevailing annual rate they could earn on equally sure 30-year Treasuries.

The box below explains how to model their question in MaxiFi Planner by comparing their Base Plan with an Alternative Plan, which involves their making extra mortgage payments equal to their 401(k) contributions and eliminating their 401(k) contributions until their mortgage is paid off.

Results

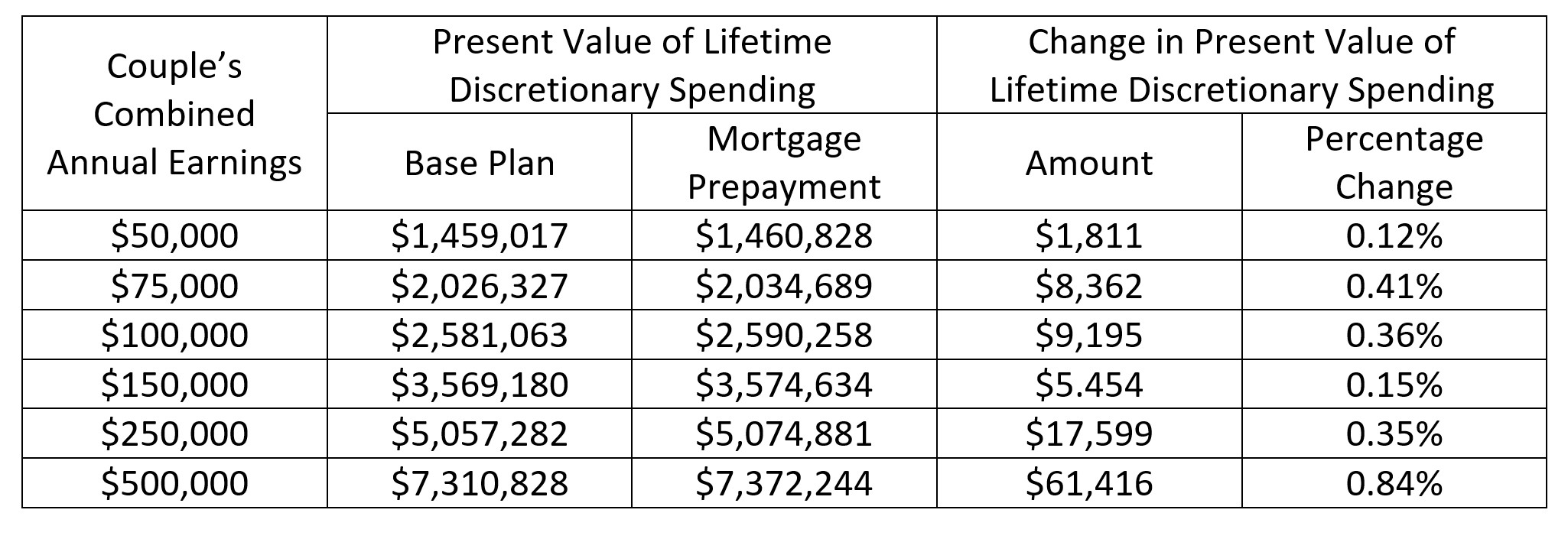

Row 3 of the table below shows the impact on the present value of Hannah and Connor’s lifetime discretionary spending of using the 401(k) contributions to pre-pay their mortgage. The other rows consider what would happen were Hannah and Connor to earn less or more and were all their other MaxiFi inputs scaled relative to row 3 based on their earnings. The bottom line for Hannah and Connor as well as for their poorer and richer versions is that they gain from pre-paying their mortgages even if they need to cut back on their retirement account contributions to make that happen. Indeed, for most couples, the lifetime discretionary spending gain is small, but not trivial.

But should Hannah and Connor really give up investing in the stock market on a tax-favored basis? This depends on their concern about risk. From the perspective – the baseline -- of using their retirement account contributions to pre-pay their mortgage, returning to their current situation means, in effect, borrowing more money at a relatively high rate in order to invest in stocks, whose returns are highly variable. Very few middle-class households actively borrow to invest in the stock market. Doing so exposes them to the possibility that they will lose their shirts on the investment, but still have to repay their borrowing. This, in effect, is what Hannah and Connor are choosing to do if they decide not to pre-pay their mortgage with what would otherwise constitute retirement account contributions invested in stocks.

Understanding the Non-Linearity of the Results

Note that the percentage lifetime spending gain first rises than falls and then rises again as we move from lower to higher-earning households. This non linearity reflects the complexities of our tax system and the relative importance of assets (and thus the difference in the mortgage borrowing and the Treasury lending rates) versus Social Security in funding retirement for the poor, middle class, and rich.

How Hannah and Connor Can Use MaxiFi Planner to Explore their Question

The couple enter their current situation as their MaxiFi Planner Base Plan. They also create an alternative profile, which they set up as follows. First, in the Alternative Profile, they tell the housing section they will pay $250 extra per month on their mortgage. They specify the $250 as an amount in today’s dollars. This means that the actual extra dollar (the nominal) payment will rise each year with inflation. That’s in keeping with the couple’s Base-Plan assumption that their 401(k) contributions will keep pace with inflation. Next, they run their Alternative Profile and look at its housing report. There they see when their mortgage will end given the extra payments. Finally, they eliminate their 401(k) contributions for the years up to the last one for which there is a mortgage payment. In the last year, they reduce their 401(k) contribution by the difference in the last year’s mortgage payment (reported in today’s dollars in the housing report) in the Alternative Profile and under the Base Plan. Finally, they rerun their Alternative Profile.

Note: Since Hannah is an economist, she knows that an apples-to-apples, risk-adjusted comparison of paying off their mortgage early or not requires entering, in MaxiFi Planner, the prevailing 30-year Treasury bond rate as the rate of return on both regular and retirement account assets. As for entering the inflation rate in MaxiFi, Hanna and Connor enter the inflation rate suggested by the difference in the 30-year Treasury bond rate of 1.944 and the 30-year Treasury Inflation Protected Securities (TIPS) rate of .41. I.e., the couple enters an inflation rate of 1.534 percent.