John uses MaxiFi's Roth Conversion Optimizer to quickly find nearly $200k in lifetime tax savings, leaving more money to enjoy in retirement

The Facts

Single individual, Age: 65

Earnings: Retired

Rent: $3,000 / month

Pension: $45,000 / year starting age 70

Regular assets: $1,250,000

IRA assets: $1,250,000

John is 65, retired, single, lives in Tennessee, and rents an apartment for $3K a month. John has $1.25 million in regular assets and $1.25 million in a regular IRA. In addition, John has a $45K nominal pension that will kick in at 70. That’s also when he’ll take Social Security, which will pay $57,582, valued in today’s dollars, per year. John’s investing in TIPS yielding 2% real.

The Base Plan

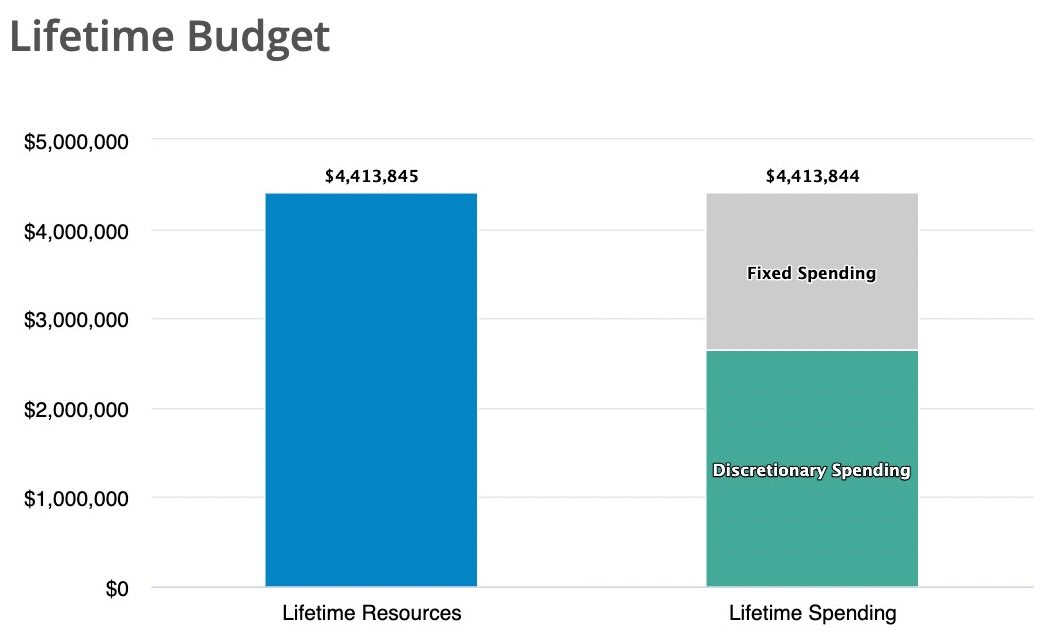

John runs his MaxiFi Base Plan with no Roth conversions and produces the outcomes below. John’s lifetime fixed spending on housing and taxes plus his lifetime discretionary spending equals (within a dollar) his lifetime resources — all measured in present value.

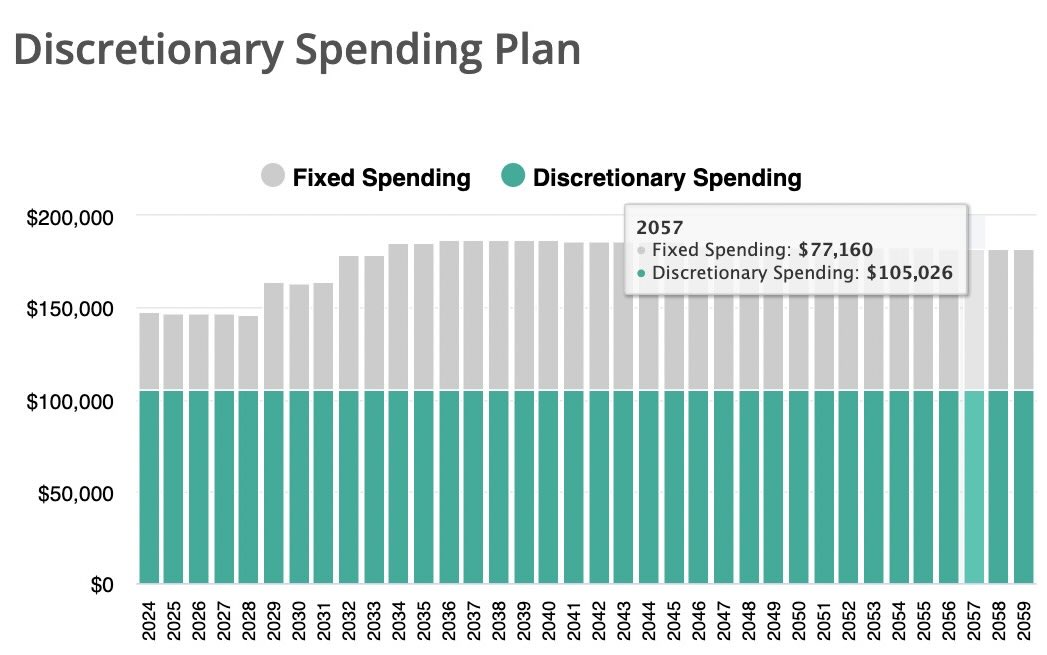

The annual spending report below shows John is able to spend $105,026 per year in today’s dollars — right through age 100, John’s maximum age of life. That’s the green bars indicating John’s annual discretionary spending. The grey bars show John’s annual fixed spending. The grey bars rise as he ages due to his paying taxes on his Social Security and pension benefits as well as his IRA withdrawals, which he intends to start at age 75.

The Roth Conversion Optimizer

Next John runs MaxiFi's Roth Conversion Optimizer. Before running it, he chooses the option to only consider conversion plans that entail no reduction in his discretionary spending. I.e., he tells it to throw out conversion options that involve spending less in the short run in order to spend more later.

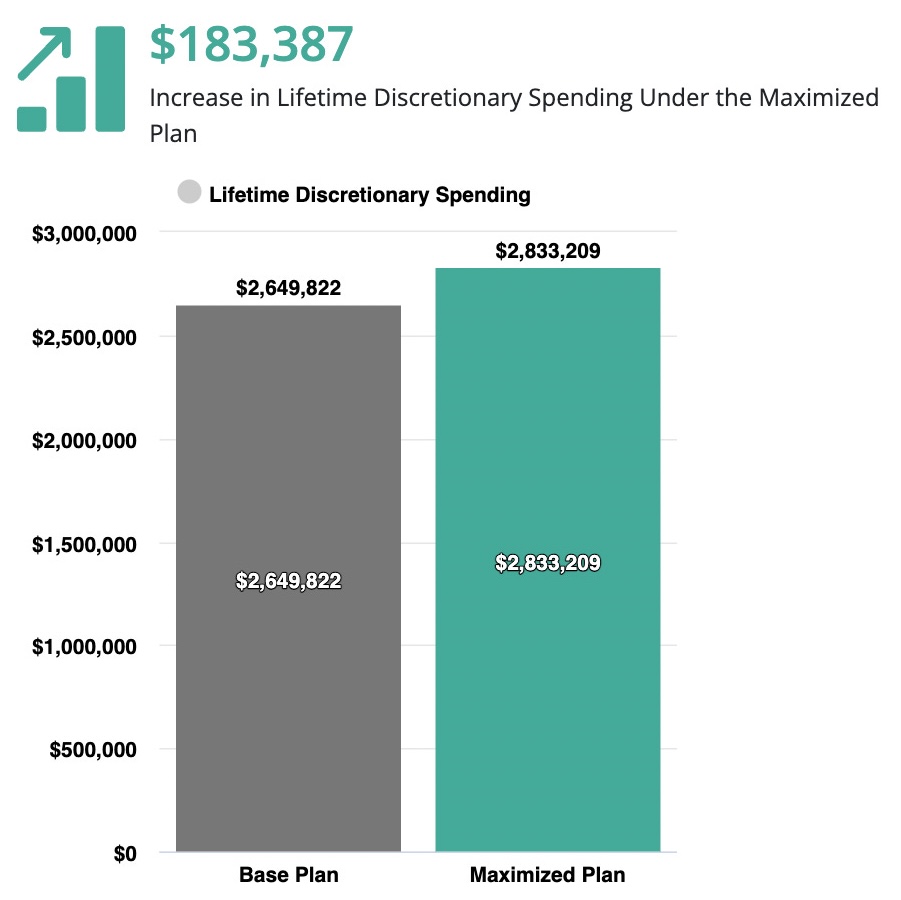

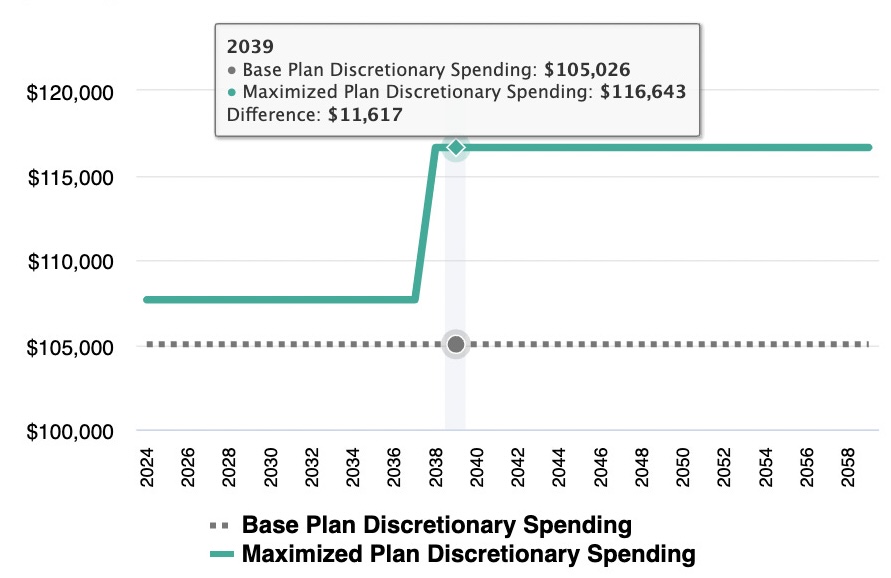

As seen in the charts below, the optimizer finds $183,387 in lifetime tax savings permitting John to spend $2,623 more per year through age 70 and $11,617 more per year thereafter. These tax savings are huge. They represent 1.6 years of discretionary spending under his no-conversions Base Plan!

MaxiFi’s Conversion Message — Go Big!

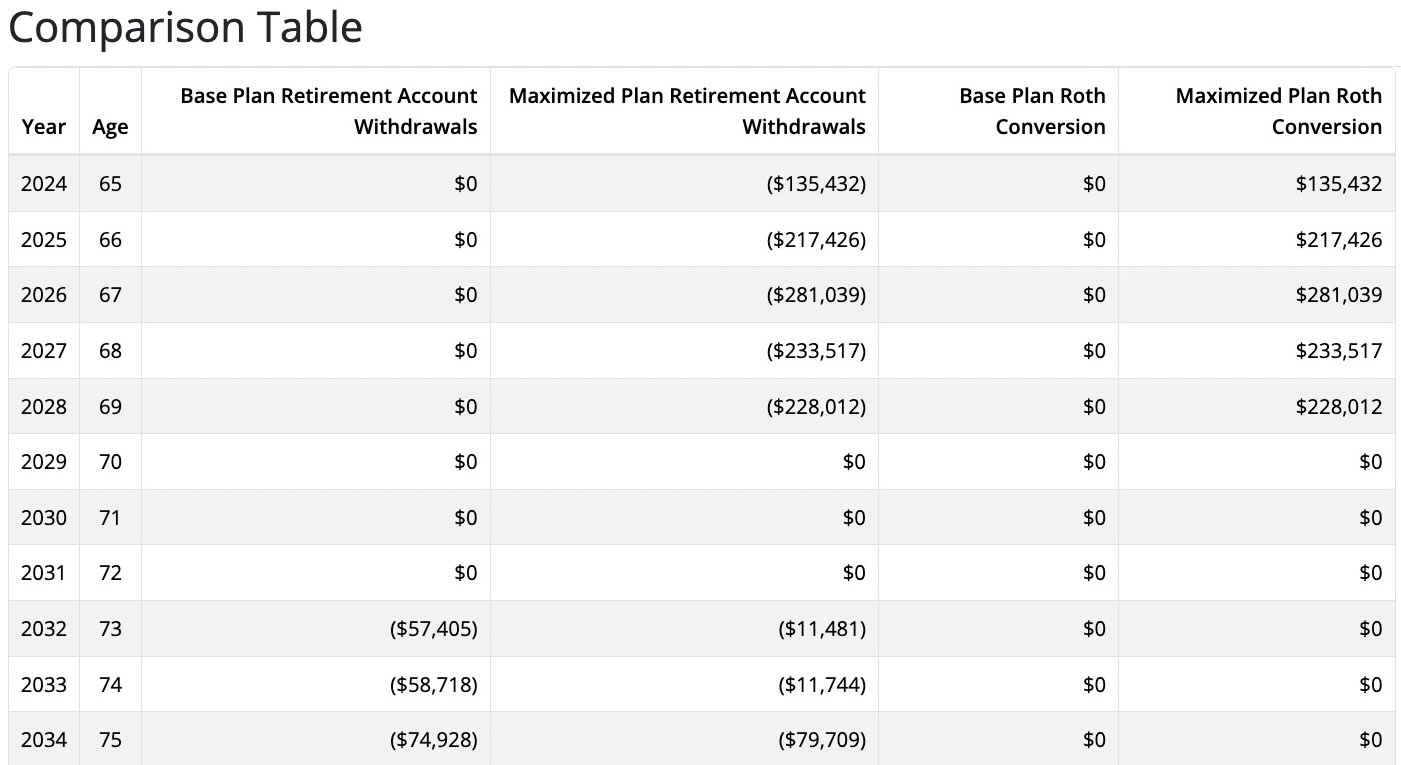

MaxiFi tells John to convert $1,095,426 (simple sum, not a present value) of his $1,250,000 IRA holdings over the next five years according to the schedule shown below. With this conversion plan, John saves $139,902 in federal taxes (Tennessee has no income tax) and $43,484 in IRMAA taxes.

The last chart compares John’s annual taxes, through age 80, in his base plan and optimal conversion plan. Before age 70, John pays dramatically more annual taxes. But from age 79 on, he pays dramatically lower taxes. A similar story holds with respect to IRMAA taxes. At 69, John pays $7,550 in Part B premiums under the conversion plan — far higher than the $2,360 he pays at that age under the base plan. But from age 77 on, his IRMAA taxes are lower. After age 80, they are dramatically lower. For example, at age 81, they are $3,364 in the conversion plan and $8,746 in the base plan.

Checking Results and Alternative Assumptions

MaxiFi’s reports provide all the details needed to verify the accuracy of its annual federal and state income taxes, FICA taxes, retirement and all other Social Security benefits, and IRMAA taxes. In particular, MaxiFi’s Year at a Glance report lets you drill down to see the elements entering into taxable federal income.

You can also run MaxiFi’s Roth Conversion Optimizer under alternative assumptions about future tax policy, old-age medical and other off-the-top spending, retirement, relocation decisions, housing changes, you name it.

Take, for example, the likely retention of TCJA — the 2017 Tax Cut and Jobs Act, now scheduled to expire in 2025. Retention of TCJA will mean lower federal tax rates, a higher standard deduction, and other features, which, on balance, spell lower future taxes for most households. Does TCJA retention eliminate John’s gains from Roth conversions? No. But his maximum gains, while still huge, are smaller — $147,837 rather than $183,387. Interestingly, the new total optimal conversions $1,072,143 are quite close to the $1,095,426 under current law (TCJA expires). Yet, conversions now extend over six, rather than five years with lower conversions per year.

What about the interaction of Roth conversions and Social Security? Suppose John planned to take Social Security immediately. How would that change his lifetime tax savings from optimal conversions, assuming retention of TCJA? They’d drop to $99,515. That’s still a massive gain — almost a full year’s discretionary spending.

Another way to view this finding is that the gain from optimizing Roth conversions is compounded by optimizing Social Security. Waiting until age 70 to collect benefits produces a $106,901 increase in lifetime spending. Maximizing Roth conversions as well adds another $147,837 for a total gain of $254,738. Hence, optimizing conversions when doing so doesn’t raise Social Security benefit taxation increases conversion gains by almost 40 percent. Indeed, it permits the gains from optimal Roth conversion to exceed those from Social Security optimization.

How Important is Getting the Timing of Roth Conversions Right?

Very important. Consider, again, the TCJA-retention case whose maximum conversion savings equals $147,837. This value is $40,761 smaller if the same $1,072,143 in conversions is spread evenly over just the next three years rather than allocated properly over the next six years. Clearly, the future is uncertain. So, Roth conversion plans need to be updated annually. But does uncertainty combined with the importance of proper conversion timing argue for holding off conversions until the future is the past? No. On the contrary, the gains from conversion depend on the number of future years one a) enjoys tax-free asset accumulation unperturbed by RMDs and b) receives distributions that don’t trigger additional federal income, state income, IRMAA, or Social Security benefit taxation. To see this, consider how much the $147,837 declines if John’s maximum age of life is 95, not 100. Now the gains are $108,256.

Run MaxiFi Yourself

The potential tax savings available from Roth conversions can be significant. In many cases, like John's, running small-scale conversion strategies produce disappointing results and large conversions are the way to go: Go big or go home. But every case is unique. In the past you would have to hunt and peck or use rules of thumb to figure out Roth conversions for your plan. Those days are over. MaxiFi’s Roth Conversion Optimizer can now, in a matter of minutes, find the optimal approach to lower lifetime taxes and increase the amount you can spend in retirement.

So run MaxiFi's Roth Conversion Optimizer yourself, or ask your financial planner to run it on your plan today!