John and Vanessa recently retired and are taking another look at their finances. They realize, given prevailing low interest rates, that their lifetime of saving matters to their ongoing spending capacity.

The Facts

Married couple, Age: 65

John’s earnings: $0

Vanessa’s earnings: $0

Combined 401K: $600,000

Regular Assets: $150,000

Housing: Own $300,000 home

John and Vanessa recently retired and are taking another look at their finances. They realize, given prevailing low interest rates, that their lifetime of saving matters to their ongoing spending capacity. Yes, they could invest in the stock market. But that’s a wild ride that could end very poorly. Tess suggests cutting their fixed expenses by downsizing their home. To examine this option, they set up their current situation as their base plan in MaxiFi. As an alternative case, they input selling their current home and moving into a smaller one.

The Base Case

John and Vanessa are 65 and married. They retired this year and each has $300,000 in 401(k) assets. When they retired their combined labor earnings were $50,000. Both John and Vanessa plan to start their Social Security benefits next year, when they both turn 66.

The couple owns a home worth $300,000 in North Carolina. They pay $3,000 annually in property taxes, $1,500 for homeowner’s insurance and another $1,500 for maintenance. The couple has $150,000 in regular assets, which they own free and clear.

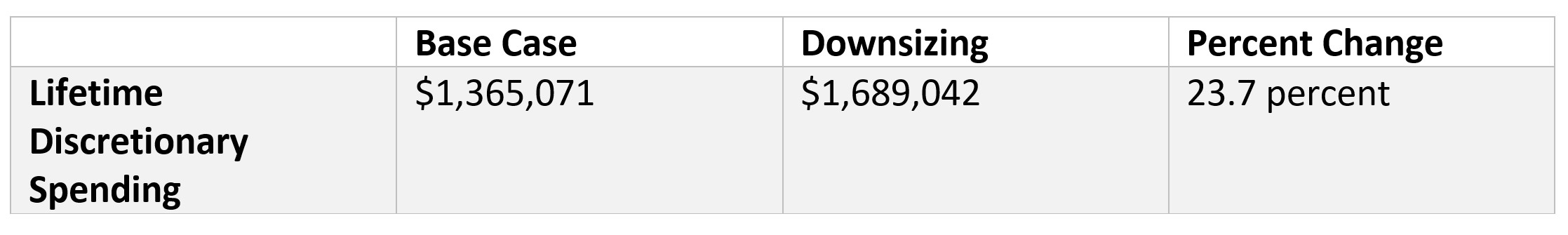

Results

For their alternative plan, Vanessa and John sell their current home and buy one worth half the cost -- $150,000. This also halves all their housing expenses. What happens to their lifetime discretionary spending (measured in present value)? It rises 23.73 percent, from $1,365,071 to $1,689,042! This means another $12,056 per year for the couple to spend visiting their grandchildren in Massachusetts. John gives Vanessa a kiss and calls a real estate agent.

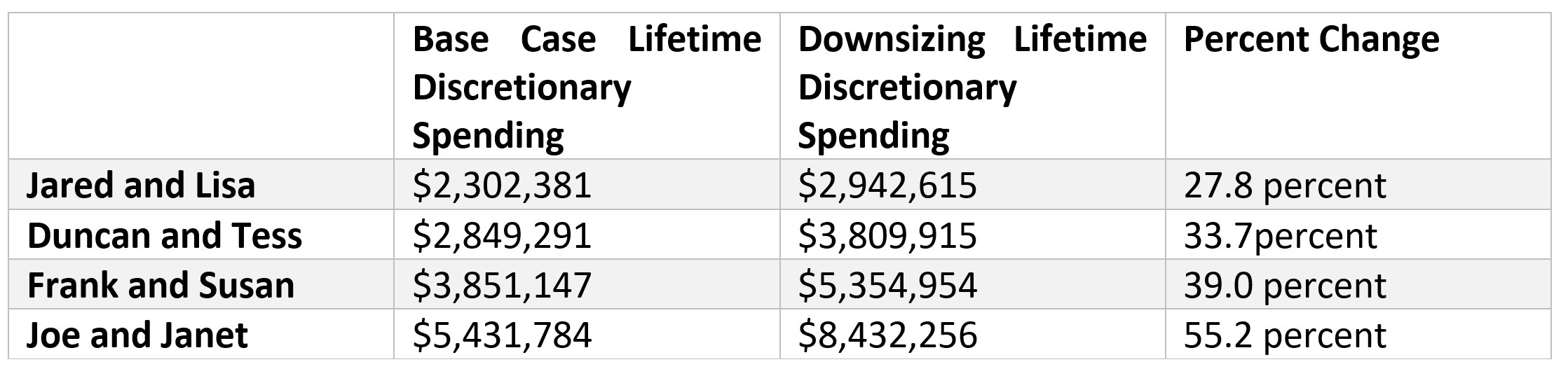

Households with Higher Incomes

Now consider four other couples that are identical to John and Vanessa except that all their inputs, including past labor earnings, are multiples of John and Vanessa’s. First, take Jared and Lisa. When they retired, their combined labor earnings were $100,000, i.e., twice that of John and Vanessa. If they downsize from their current home valued at $600,000 to another home half its price, their lifetime discretionary spending rises 27.81 percent – from $2,302,381 to $2,942,615.

Next, we have Duncan and Tess. Their combined labor earnings when they retired were $150,000. They currently live in a home valued at $900,000. If they downsize to a $450,000 home, their lifetime discretionary spending increases by 33.71 percent – from $2,849,291 to $3,809,915.

The next couple is Frank and Susan. Their joint labor earnings at retirement were $250,000 and they currently live in a home valued at $1,500,000. If they downsize to a home valued at $750,000, their lifetime discretionary spending rises by 39.05 percent – from $3,851,147 to $5,354,954.

Finally, we have Joe and Janet. When they retired, their combined labor earnings were $500,000. Right now, they live in a $3,000,000 home. If they downsize to a home valued at $1,500,000 their lifetime discretionary spending rises by 55.24 percent – from $5,431,784 to $8,432,256.

Why Are the Gains From Downsizing Larger for the Rich?

Low-income John and Vanessa experience a 23.7 percent increase in lifetime spending from halving their home. For high-income Joe and Janet, the gain is more than twice as large – 55.2 percent. How come? The answer is that those with higher income face far higher taxation, including Medicare Part B premiums. Hence, the value of their homes as well as its expenses are disproportionately high relative to what they can spend from their after-tax resources.

Take Away – “House Poor” May Be You!

These examples of downsizing weren’t cooked to produce their astounding findings. The message is clear. We may all be spending more than we think on housing – even on homes on which we have paid off the mortgage. The only way to know is to consider how alternative housing arrangements impacts your remaining lifetime spending. Some of us may be holding onto, what for us, are expensive homes as a type of emergency fund. “If I need money, say, for a nursing home, I can always sell my house.” Yes, but you can downsize now, put the equity so released into, for example, inflation-indexed Treasury bonds (Treasury Inflation-Protected Securities) and still spend more for the rest of your life. Why? Because your annual housing expenses will be lower, not to mention earning some interest on the bonds.