Other personal financial planning tools ask you to guess: How much do you need for a secure financial future?

MaxiFi ends the guesswork.

It’s the only personal financial and retirement software powerful and accurate enough to calculate your highest sustainable living standard — starting today — with a plan to maintain and raise that amount — for life.

Peace of Mind

More Money

Smarter Decisions

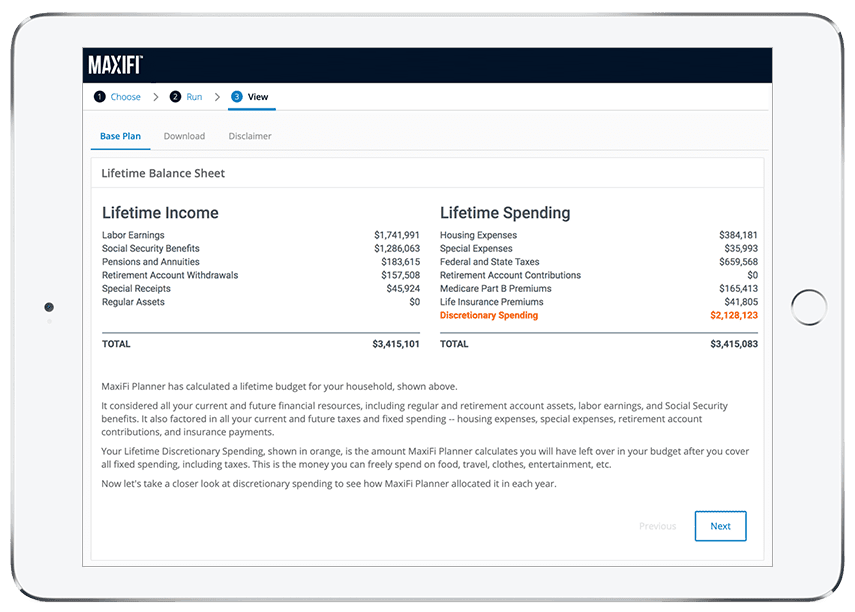

Step 1 Plan for a Lifetime

Conventional financial planning products use simplistic, outdated “rules of thumb” to “guesstimate” income needs in retirement. They don’t calculate what you can afford to spend every year over the course of your life. We do.

MaxiFi analyzes your current and future finances using powerful algorithms developed by acclaimed economist Laurence Kotlikoff.

We consider earnings, assets, retirement accounts, taxes, Social Security, housing, and other fixed spending to calculate annual discretionary spending budgets that preserve your living standard.

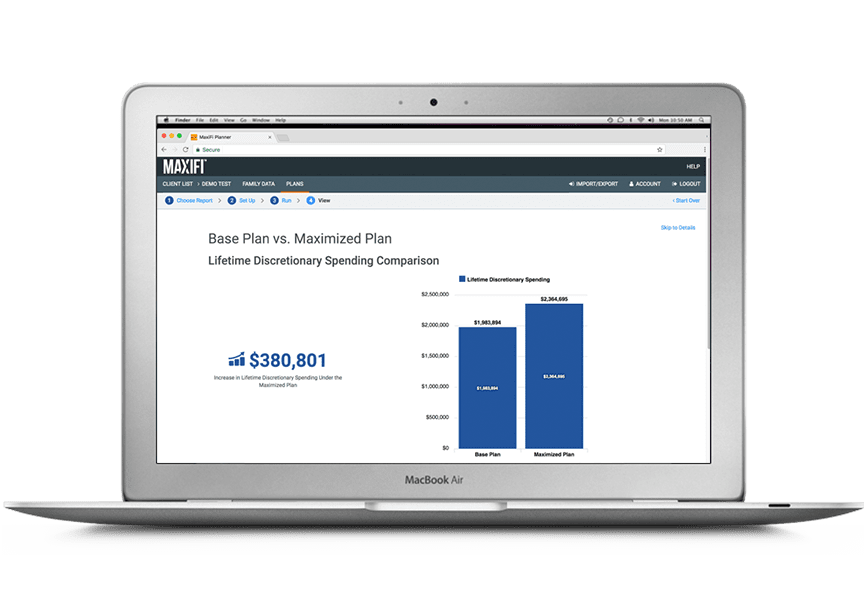

Step 2 Find More Money

MaxiFi’s optimization engine runs thousands of scenarios to find safe ways to improve your standard of living by:

- Maximizing Social Security benefits—determining which benefits to take and when

- Calculating tax efficient retirement withdrawal start dates

- Optimizing use of Roth versus Non-Roth accounts

- NEW Optimizing Roth conversions

These changes can mean tens to hundreds of thousands of extra dollars in lifetime spending.

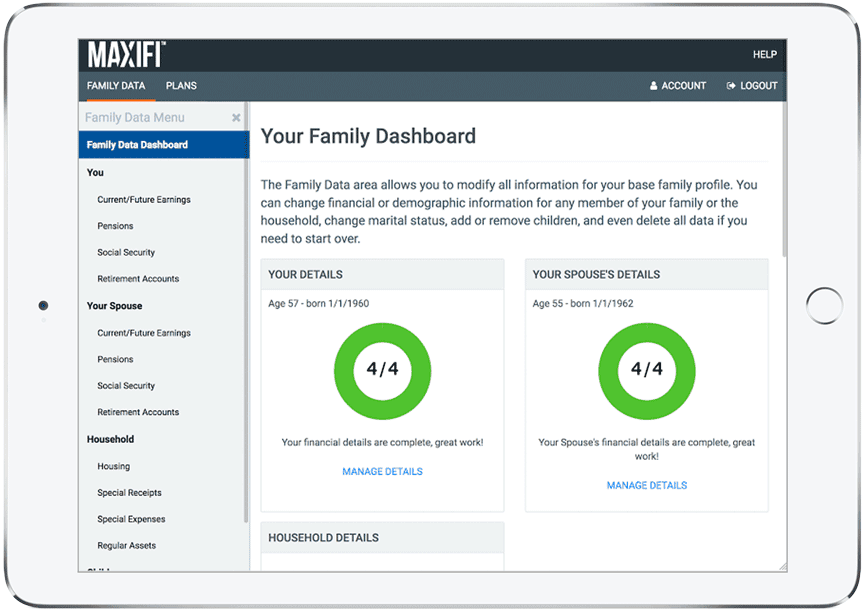

Step 3 Make Smarter Decisions

Take the guesswork out of financial decisions at every stage of life––whether you are just starting out, building a family, considering when to retire or wanting to stretch your retirement dollars further.

Run unlimited “What-If“ scenarios to see how different decisions impact your overall financial plan and sustainable standard of living.

Clear charts of annual lifetime income, fixed and discretionary spending, taxes, Social Security benefits, and insurance let you dig into the details.

Read our Case Studies about using MaxiFi to make smarter decisions

Step 4 Create a Budget

When you're happy with your plan, create a budget for the year with a few clicks. MaxiFi's Budget Tracker tool helps you visualize and stay on track with your income, spending, and saving targets for the year.

You can review and update your progress at any time from any device, or export your budget and transactions to Excel.

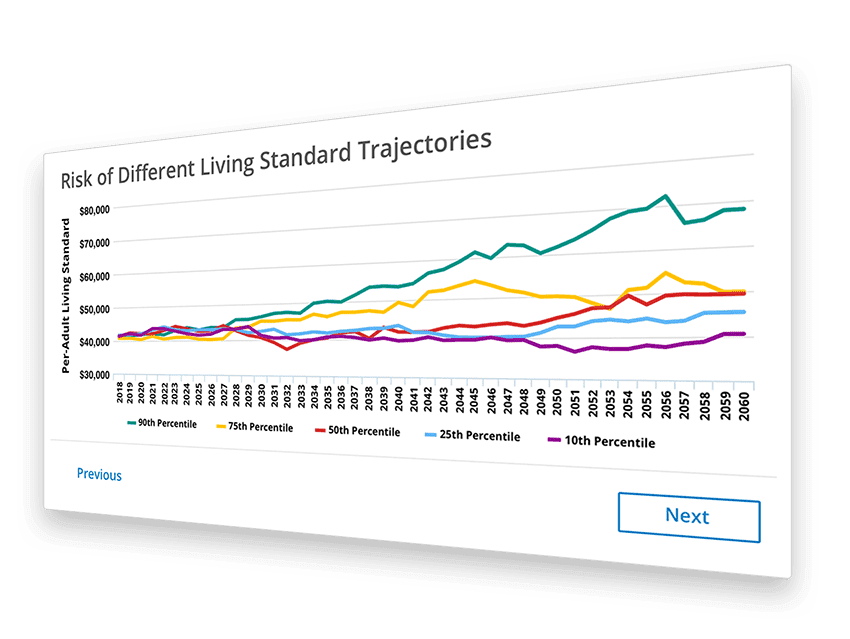

Step 5 Assess Risk and Reward

Investing is risky business. So is spending. Both can be too aggressive or too cautious.

MaxiFi’s Monte Carlo simulations let you compare the living standard risk and reward from different investment strategies and spending behaviors so you can make smart decisions.

Conventional financial planning tools use old-school Monte Carlo. They set a spending target and never change it to reflect reality.

Our state-of-the-art Living Standard Monte Carlo® incorporates changing investment returns. If returns are low, MaxiFi adjusts discretionary spending so your living standard remains stable. If returns are high, MaxiFi adjusts spending to reflect improvement.